The Single Strategy To Use For Investment Banking - Tyton Partners

Investment Banking - Who We Look For - Goldman Sachs Things To Know Before You Buy

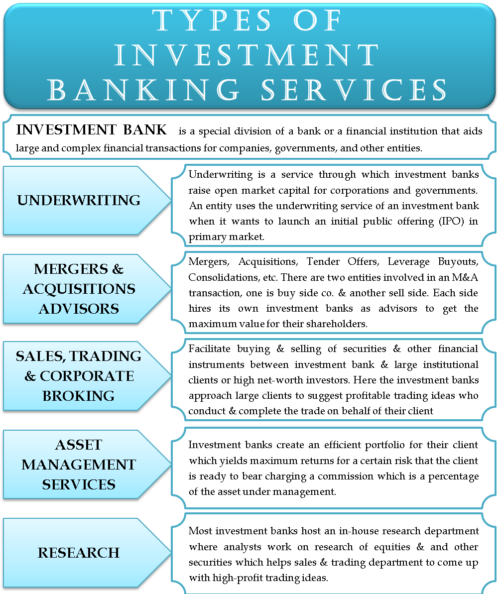

Understanding Financial Investment Banking Investment banks finance new debt and equity securities for all types of corporations, aid in the sale of securities, and help to facilitate mergers and acquisitions, reorganizations, and broker trades for both institutions and private financiers. Investment banks also supply guidance to companies concerning the issue and positioning of stock.

Broadly speaking, financial investment banks assist in large, complex monetary deals. They may offer guidance on how much a company deserves and how best to structure an offer if the investment banker's client is considering an acquisition, merger, or sale. It might also consist of the releasing of securities as a method of raising money for the customer groups and developing the documentation for the Securities and Exchange Commission necessary for a business to go public.

What is Investment Banking - Role and Objectives of Investment Banking

In theory, financial investment lenders are specialists who have their finger on the pulse of the present investing climate, so companies and organizations turn to financial investment banks for guidance on how best to prepare their development, as investment bankers can tailor their recommendations to today state of financial affairs. Basically, financial investment banks work as intermediaries in between a company and financiers when the business desires to release stock or bonds.

Best Guide On Investment Banking Career (Best Expert Advice)

The Ultimate Guide To Corporate investment banker job profile - Prospects.ac.uk

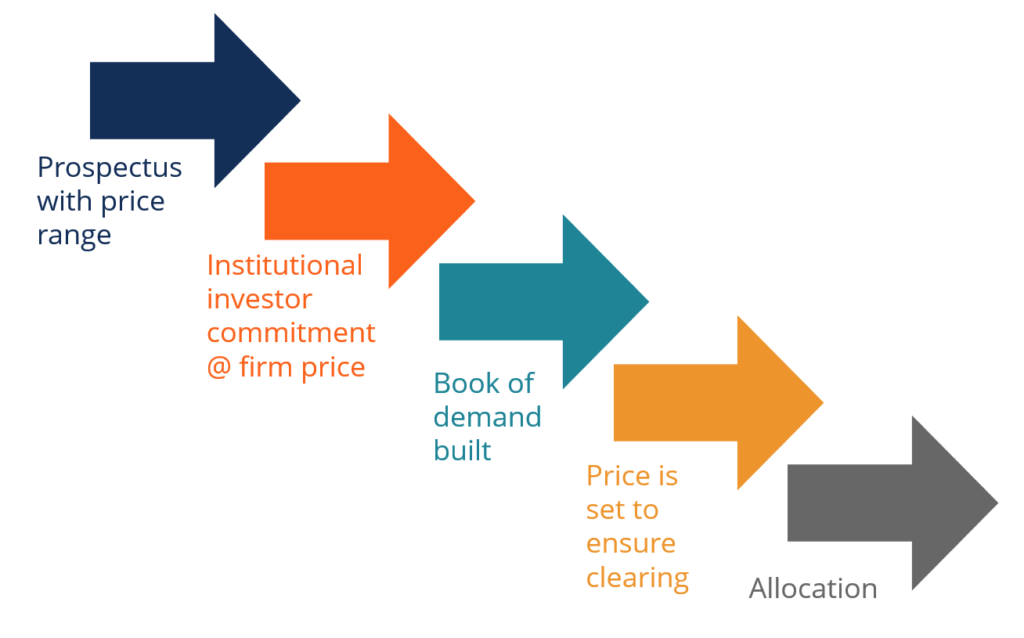

Frequently, when a company holds its going public (IPO), a financial investment bank will purchase all or much of that business's shares straight from the business. Consequently, as a proxy for the company holding the IPO, the investment bank will offer the shares on the marketplace. This makes things a lot easier for the business itself, as they efficiently contract out the IPO to the financial investment bank.

World's Best Investment Banks 2019: Financial Technology - Global Finance Magazine

In doing so, it also handles a substantial quantity of risk. Though experienced This Article Is More In-Depth use their expertise to accurately price the stock as best they can, the financial investment bank can lose money on the offer if it ends up it has actually misestimated the stock, as in this case, it will often need to sell the stock for less than it initially spent for it.